Member Login |

Hotel Spas Lag Industry Recovery but Forecasts Indicate Strong Future Performance

publication date: Mar 29, 2012

|

author/source: Andrea Foster

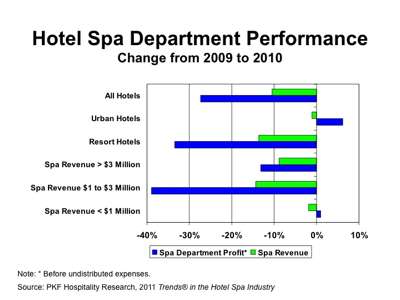

Hotel Spas Lag Industry Recovery -

Since 2007, PKF-HR has surveyed the financial performance of U.S. hotel spas for its annual Trends® in the Hotel Spa Industry report. The 151 hotels that submitted their 2010 data for the 2011 edition of the survey averaged 380 guest rooms in size and achieved an average occupancy of 62.3 percent and an ADR of $224.32. The sample was limited to spas that are operated by the hotel. Leased spa operations, day spas, destination spas, and hotel spas with less than $300,000 annual revenue were excluded from the survey sample. The following paragraphs summarize the findings of our 2011 Trends® in the Hotel Spa Industry report. Revenues On average, the hotel spas in our sample suffered a 10.5 percent decline in departmental revenue in 2010. Urban hotel spas experienced less of a drop in revenue (-1.2%) compared to the spas at resort hotels (-13.6%). We attribute the relative strength of urban hotel spa performance to the faster recovery of large metropolitan hotel markets compared to resort locations, and the ability of urban hotel spas to supplement hotels guests with patrons and members from the local community. Spa revenue declined 11.1 percent in 2010 when measured on a dollar-per-available-room basis, but declined 17.0 percent on a dollar-per-occupied-room basis. The potential reasons for this inequity are that a lower percentage of hotels guests purchased spa services in 2010 compared to 2009, the dollars spent per hotel guest were less in 2010, or local residents comprised a greater share of hotel spa customers. Expenses Facing a decline in revenues, hotel spa managers were able to control the expenses within their department. From 2009 to 2010, spa managers reduced their total direct departmental operating expenditures by 3.9 percent. Given the variable nature of most spa department expenses, the reduced volume of business certainly contributed to the cost reductions. The cost greatest reductions (-4.9%) were achieved by cutting the amount spent on such operational expenses as ambience and decorations, health and beauty products, laundry, linen, and uniforms. Even labor costs, notoriously difficult to control within spas, were cut by 3.8 percent in 2010. Profits Despite the best efforts of managers to control their costs, hotel spa department profits declined by 27.4 percent in 2010. This follows a 13.9 percent decline in hotel profits in 2009. Per the Uniform System of Accounts for the Lodging Industry, hotel spa department profits are calculated before the deduction of undistributed expenses and fixed charges. When analyzing changes in profits by property type, we find a sharp contrast in the 2010 experience of spas located in urban hotels versus those operating within resort properties. Facing less of a decline in revenue (-1.2%), but still accomplishing a 2.6 percent cut in expenses, urban hotel spas enjoyed a 6.2 percent increase in departmental profits. On the other hand, a 4.3 percent cut in operating expenses at resort spas was not enough to offset the 14.2 percent fall off in revenue. The net result was a significant 33.4 percent decline on the bottom-line for resort spas from 2009 to 2010. While the resort spas did suffer more than urban spas in 2010, it should be noted that these operations achieve superior departmental profits than urban hotel spas when measured on a per-available-guest room, per-occupied room, per-treatment room, and per-square-foot basis, as well as a percent of departmental revenue. Further, spa department revenues represent a larger portion of total hotel revenue at resort properties (3.9%), compared to the revenue contribution at urban hotels (3.1%). Future Anecdotally we have heard from our clients that spa revenues began to grow in 2011 over their 2010 levels. In addition, we know that the upper-tier chain-scales are leading the lodging industry recovery, and these are the properties in which most hotel spas operate. Finally, from a demographic point of view, a greater share of household expenditures is being spent on “health and personal” purchases, so as income levels start to rise (as forecast by Moody’s Analytics), so to will people’s budgets for health and wellness expenditures. According to the December 2011 edition of Hotel Horizons®, PKF-HR is forecasting annual RevPAR levels for U.S. hotels to increase between 4.7 and 5.3 percent from 2012 through 2015. As we enter a period of prosperity for the lodging industry in 2012 and beyond, we believe spa revenues will repeat their historical trend and lead the pace of revenue growth.    Andrea Foster serves as Vice President in the Boston office of PKF Consulting USA, as well as the National Director of Spa Consulting Services. To purchase a copy of the 2011 Trends® in the Hotel Spa Industry report, please visit www.pkfc.com/store. This article was published in the February 2012 edition of Lodging. [1] PKF-HR Trends® in the Hotel Industry – full service hotels. |

Search the SiteEducator Profiles |

Over the years, PKF Hospitality Research (PKF-HR) has analyzed the

cyclical nature of lodging industry. Most recently, a lot of attention

has been paid to the pace of recovery from the depths of the industry

recession in 2009. Typical of historical recovery sequences, lodging

demand and occupancy levels bounced back strongly in 2010, followed by

real increases in average daily room rates (ADR) in 2011.

Over the years, PKF Hospitality Research (PKF-HR) has analyzed the

cyclical nature of lodging industry. Most recently, a lot of attention

has been paid to the pace of recovery from the depths of the industry

recession in 2009. Typical of historical recovery sequences, lodging

demand and occupancy levels bounced back strongly in 2010, followed by

real increases in average daily room rates (ADR) in 2011.