| | Meeting Planners Optimism Rising | By Robert Mandelbaum

Meeting Planners Optimism Rising | By Robert Mandelbaum

As

U.S. lodging industry performance has turned positive in 2010, so too

has the attitude of meeting planners, though not quite to the same

degree. While the temperament of association, corporate, government and

independent planners cannot be characterized as exuberant, the emergence

of optimism provides hope for hoteliers that the group demand segment

is now on the path towards recovery. As

U.S. lodging industry performance has turned positive in 2010, so too

has the attitude of meeting planners, though not quite to the same

degree. While the temperament of association, corporate, government and

independent planners cannot be characterized as exuberant, the emergence

of optimism provides hope for hoteliers that the group demand segment

is now on the path towards recovery.

According to a national survey of 148 planners, 43 percent of the

respondents felt that the general "health" of the meetings industry will

be better in 2011 as compared to 2010. This is a complete reversal of

opinion from three years ago when the same percent of the planners

diagnosed the industry as deteriorating in condition. The survey was

sponsored by ConventionSouth magazine and conducted by Colliers PKF Hospitality Research in early September 2010.

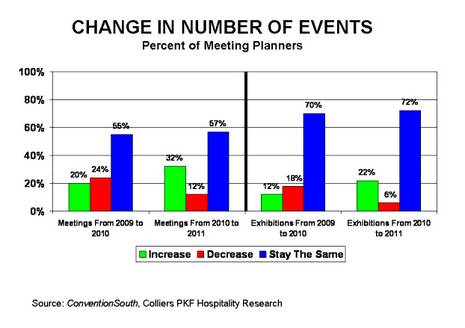

Volume Up

Of greatest interest to hoteliers is the increasing number of

planners that expect the volume of events they handle to grow in 2011.

Nearly one-third (32%) of the planners surveyed stated that the number

of meetings they will be responsible for in 2011 will be greater than

the number they are organizing in 2010. Among exhibition organizers, 22

percent expect an increase in events next year. These percentages are

not overwhelming, so what may be of more significance is the fact that

the number of planners expecting their meeting counts to decline in 2011

is half that recorded in the 2009 survey.

Attendance expectations are slightly more optimistic than the outlook

for the number of events. Thirty-seven percent (37%) of the planners

believe attendance at their events will rise in 2011. More importantly,

only six percent (6%) foresee a decline in attendance, down from 18

percent of the planners that reported a decline in attendance in 2010.

Less Pressure

Corporate and association budgets for meetings and exhibitions may

not be plentiful, but they appear to be growing. Just over one quarter

(26%) of the planners said they will be spending more per meeting in

2011 than they did in 2010, while only 10 percent expect continue to cut

costs.

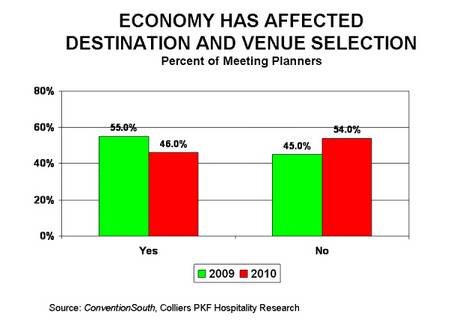

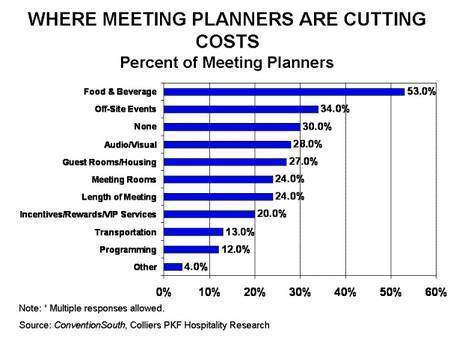

Less budget pressure is further illustrated by the guidance given to

planners by their organizations. Thirty percent of the respondents

stated they will not have to cut any costs in 2011, while only 28

percent are having to consider secondary or tertiary markets an effort

to save money. In fact, over 50% of the planners cited that the economy

is no longer affecting their choice of destinations and meeting venues.

A Disconnect

While the pressure to cut costs may be diminishing, it has certainly

not gone away. Overall affordability was rated as the most important

criteria when selecting an event destination. However, when focusing on

the areas of cost containment, there appears to be a disconnect between

meeting planners and hoteliers.

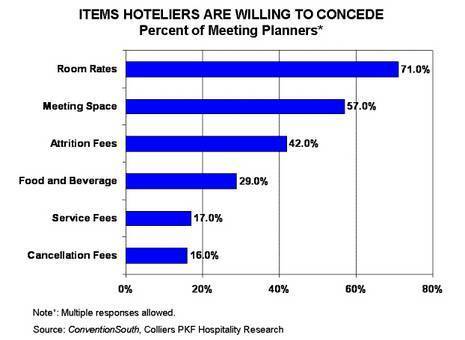

In last year's survey, guest rooms were ranked as the second most

frequent area for cost containment. In the current survey, room rates

declined in importance to number five as a cause for concern. While

meeting planners are becoming less compelled to negotiate room rates,

they believe that hotel managers are more than willing to do so. Almost

three-quarters (71%) of the planners surveyed identified room rates as

the number one item hoteliers are willing to concede. On the other hand,

hotel managers are less willing to budge on reductions in service and

cancellation fees.

Early Stages

According to our survey of meeting planners, 2011 should mark the

first year of recovery for the group demand segment in the U.S. While

the majority of respondents believe the number of events, event

attendance and meeting expenditures will remain the same as they did in

2010, the number of planners expecting an increase in these measures now

outweighs the number expecting a decrease. By 2012, hotel managers will

hopefully have enjoyed tangible growth in group room nights, thus

bolstering their ability to be more aggressive with room rates.

Robert Mandelbaum is the Director of Research Information Services for Colliers PKF Hospitality Research (www.pkfc.com).

Special thanks to Marlane Bundock, Managing Editor of ConventionSouth,

for sponsoring the survey. This article was published in the December

2010 edition of Lodging.

About Colliers PKF CONSULTING USA

Headquartered in San Francisco, Colliers PKF Consulting USA (www.pkfc.com)

is an advisory and real estate firm specializing in the hospitality

industry. Colliers PKF Consulting USA is owned by FirstService

Corporation and is a subsidiary of Colliers International. The firm

operates three companies: Colliers PKF Consulting USA, Colliers PKF

Hospitality Research, Colliers International Hotels. The firm has

offices in New York, Boston, Indianapolis, Chicago, Philadelphia,

Washington DC, Atlanta, Asheville, Jacksonville, Orlando, Tampa,

Houston, Dallas, Los Angeles, Bozeman, Miami, Portland, Seattle,

Sacramento, and San Francisco.

Colliers PKF Consulting USA offers hotel appraisal and hotel valuation services, hotel market studies, hospitality litigation support, and hotel advisory services. Colliers International Hotels offers hotel brokerage and hotel transaction services. Colliers PKF Hospitality Research produces Hotel Horizons®, an econometrically based hotel forecast, BenchmarkerSM, a customized comparative hotel benchmark report, and Annual Trends® in the Hotel Industry, a historical hotel financial publication featuring rich hotel statistics, as well as hotel research services.

Robert Mandelbaum

Director of Research Information Services

Email: robert.mandelbaum@pkfc.com

ORGANIZATION

Colliers PKF Hospitality Research Colliers PKF Hospitality Research

www.pkfc.com

3475 Lenox Road | Suite 720

USA

- Atlanta, GA 30326

Phone: (404) 842-1150

Fax: (404) 842-1165

Email: robert.mandelbaum@pkfc.com

|